The Fat Protocol Fallacy

One could suggest to rename the fat protocol thesis to the Fat Protocol Fallacy: the higher percentage protocols grab of the aggregate value, the less valuable the whole space becomes.

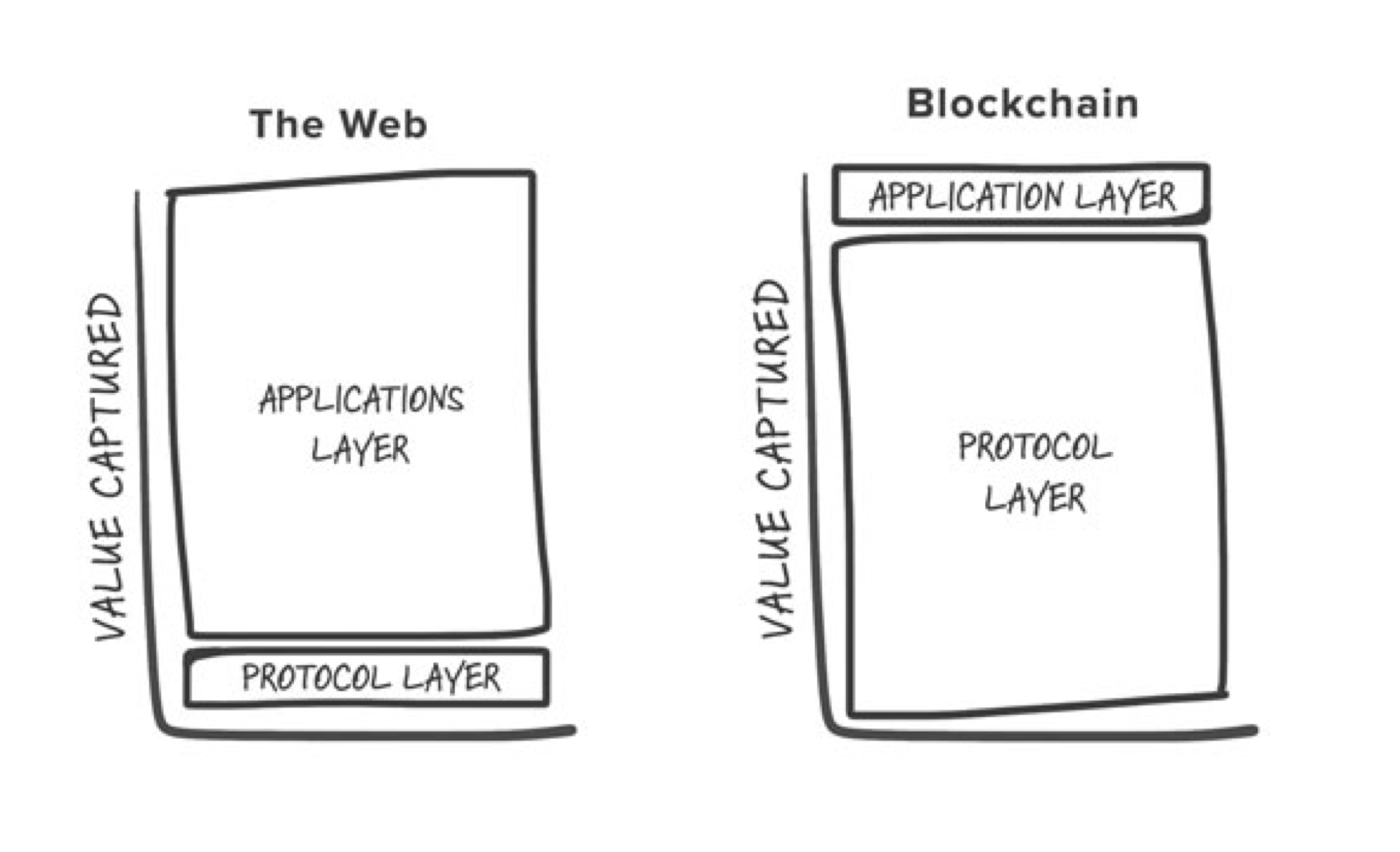

Joel Monegro's seminal Fat Protocols post introduced the fat protocol thesis for the blockchain industry.

While Joel had many great insights that can lead one to the thesis, and while directionally the blockchain industry may have slightly fatter protocols than the web, I think this framing led the entire space towards a fundamentally flawed direction.

There are many "protocol layer"s in life - the web has one indeed, but others are electricity, plumbing, roads, law, money, to name a few. These protocols serve the public to facilitate the economic activity of countless services, products, transactions; the "application layer". The protocols are valuable parts of our lives because they are simple, cheap and fast to access via the applications that leverage them. We use roads because it's seamless to hop on a bus or your car and drive through one. Electricity is everywhere because I can hook up any electric application to it and turn it on. Sometimes we have to "switch the blockchain" by going from 110V to 220V or driving on the other side of the road. It's doable, but even that becomes painful.

The applications built on all these protocols are worth many more multiples than their protocol layers. That is because value accrues to where consumers of a service or product are willing to pay for utility. Implicit in that "willingness to pay" is the utility function, benefit minus cost. If the cost is high, such as figuring out how to use a service, or how to pay for it, or fix it when it's broken, than the utility may turn out to be negative. A huge part of applications is bringing down that cost by taking away the complexity of protocols. Protocols that scale end up becoming more complex on the edges because they have to support billions of people. And billions of people behave differently. So even if a protocol at its core is simple, it gets more complex over time as it tries to cover more edge cases.

The fat protocol thesis assumed an inverse relationship: since the protocols enabled by protocols are more complex and enable more sophisticated forms of value transaction, they should be more valuable than less sophisticated ones, such as those in the web stack. To me this is an investor's way of reading the future. We're all biased by our own world view's and I can see how an investor looks at this fascinating complexity of blockchain protocols and subconsciously assigns more value to it (I don't blame them, they are fascinating).

The corollary to the fat protocol thesis, 9 years after it came out, is that the market cap of protocols is higher than that of applications and companies. If you look at the market today that is kind of true. Not as drastically as the thesis may suggest, but still. I would argue however that we're in this situation not because the fat protocol thesis is correct, but because

- Lack of regulation catalyzed speculative behavior, which protocols and their tokens are better suited for.

- The increasing complexity of protocols, perhaps inspired by the fat protocol thesis, added major friction to the creation of new applications. Sadly we still have very little net new use cases enabled by blockchains (I would argue digital gold and stablecoins are the only two).

Given this, one could suggest to rename the fat protocol thesis to the Fat Protocol Fallacy: the higher percentage protocols grab of the aggregate value, the less valuable the whole space becomes.

We want highly valuable applications, because billions of consumers will never use protocols directly. If blockchains are to be used by the whole world, protocols need to become simpler, capture less value, thereby facilitating the creation of more valuable applications which draw more people to use these applications, creating a positive feedback loop.